Reason Code Descriptions and Resolutions

Reason Code 1461A

Description:

Your claim includes a value code (12 — 16 or 41 — 43) which indicates that Medicare is the secondary payer; however, the claim identifies Medicare as the primary payer.

Resolution:

- If your services are not related to the MSP record for no-fault, liability, workers' compensation, or black lung, (value code 14, 15, 41, or 47), submit the claim showing Medicare as the primary payer. Ensure that your claim does not include any MSP value codes, or diagnosis codes that are related to the MSP situation.

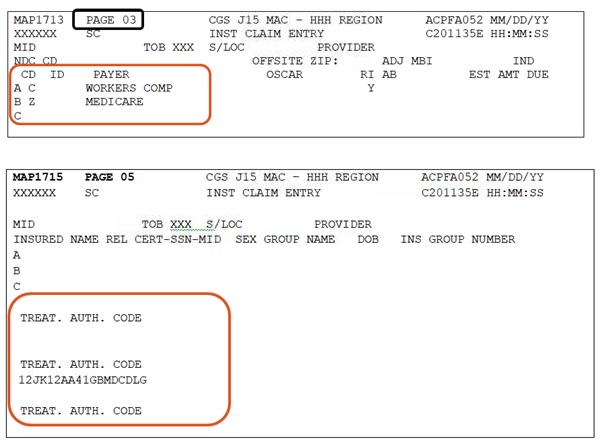

- If the primary insurance denied payment or applied the payment towards the beneficiary's deductible, report the appropriate value code with a zero dollar amount. The Payer/Payer Code field should reflect the primary insurer on line A, and Medicare on line B as the secondary payer.

For assistance in submitting Medicare Secondary Payer claims, refer to the following resources.

Reason Code 30720

Description:

This reason code is assigned to home health type of bills 32X, 3X9, 3X7 or 3X(Alpha) (adjustments) when the treatment authorization code is not present or is not valid, and the condition code 21 is not present.

Resolution:

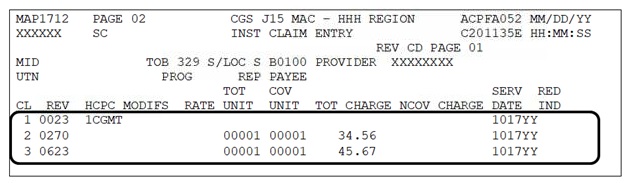

The treatment authorization code is an 18 position Claim-OASIS Matching Key which is calculated by the Grouper software. It contains the start of care date, the date the assessment was completed, the reason for the assessment, whether the episode was "early" or "late" and the clinical and functional domain points under the four equation model of the HH PPS case mix system.

- In Medicare Secondary Payer (MSP) situations, ensure that the treatment authorization code is entered on the corresponding Medicare payer line. If Medicare is the secondary payer, enter the treatment authorization code in the second TREAT. AUTH. CODE field.

- Review the TREAT. AUTH. CODE field on Claim Page 05 via the Fiscal Intermediary Standard System (FISS) Direct Data Entry (DDE) to ensure the treatment authorization code is present and is valid. The format of the code is made up of numeric and alpha characters (e.g., 12JK12AA41GBMDCDLG). To prevent claims from receiving this reason code, use the "Treatment Authorization Code Structure

" worksheet to assist in determining the structure of the code being reported on your home health RAPs and final claims.

" worksheet to assist in determining the structure of the code being reported on your home health RAPs and final claims.

Position 1 and 2 = numeric

Position 3 and 4 = alpha

Position 5 and 6 = numeric

Position 7 and 8 = alpha

Position 9 = numeric

Position 10 = 1 or 2

Position 11 – 18 = alpha

Reason Code 30949

Description:

The adjustment (type of bill XX7, or XX8) or reopening request (type of bill XXQ) does not include a claim change reason code.

Resolution:

When submitting an adjustment (XX7) or a cancel (XX8), a Claim Change Reason Code is required. Choose only one of the following codes that best describes the adjustment request.

D0 – change dates of service

D1 – change charges

D2 – change revenue/HCPCS code

D7 – Change to make Medicare secondary

D8 – Change to make Medicare primary

D9* – Other/multiple changes

E0 – change patient status

When D9 is used, an explanation of the adjustment must be included in the Remarks field (FL 80 or FISS Claim Page 04). The adjustment request will be suspended for review.

Refer to the Adjustments/Cancels web page for additional information.

When submitting a Reopening request for one of the following reasons, for claim corrections, untimely filing rejections or ordering/referring denials, one of the above codes must be submitted as instructed on the Reopenings web page.

Posted: 09.14.2020

Reason Code 30993

Description:

The claim was submitted with an incorrect Medicare Beneficiary Identifier (MBI), as no match is found in the Common Working File (CWF).

Resolution:

Please verify the MBI reported on the claim with the patient's Medicare card; correct and resubmit. Refer to the Checking Beneficiary Eligibility web page for information about checking eligibility.

Posted: 02.21.2020

Reason Code 30995

Description:

For services provided on or after January 1, 2020, the Medicare Beneficiary Identifier (MBI) must be submitted. With a few exceptions![]() , Medicare will reject claims submitted with a Health Insurance Claim Number (HICN).

, Medicare will reject claims submitted with a Health Insurance Claim Number (HICN).

Resolution:

There are 2 ways you can get the patient's MBI.

- Ask your Medicare patient

- Use the myCGS MBI Look-up tool

- Check the remittance advice if you previously saw the patient and received a claim payment.

Refer to the SE18006 - New Medicare Beneficiary Identifier (MBI) Get It, Use It![]() MLN Matters article

MLN Matters article

Posted: 03.11.2020

Reason Code 31018

Description:

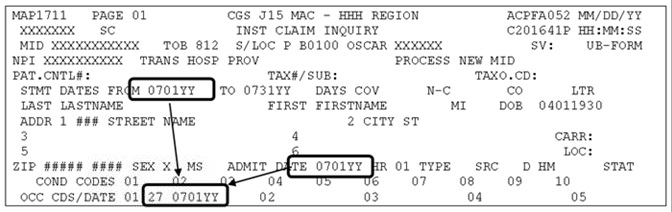

- There is a span of more than 60 days between the "FROM" and "TO" date submitted on the claim.

- Example 1: "FROM" date billed is March 15 and the "TO" date billed is May 14, which equals 61 days

- Example 2: "FROM" date billed is March 15, and the "TO" date billed is July 12, which equals 120 days

- There is less than 60 days between the "FROM" and "TO" date submitted, and a patient status code "30" appears on the claim.

- Example: "FROM" date billed is March 15 and the "TO" date billed is May 11, which equals 58 days. Patient status code "30" indicates the beneficiary remains a patient of the HHA at the end of the episode; therefore, the span between the "FROM" and "TO" dates cannot be less than 60 days.

Resolution:

- Under the Home Health Prospective Payment System (HH PPS) the unit of payment is a 60-day episode of care

- Verify the "FROM" and "TO" dates submitted on home health claims to ensure there is never a span of more than 60 calendar days submitted on a final claim (type of bill 329)

- To determine the 60th day of an episode based on the "FROM" date, access the Home Health 60-Day Episode Calendar Schedule

quick resource tool.

quick resource tool. - If the span of days is less than 60 days, and the patient was discharged, enter the appropriate patient status code as of the "TO" date on the claim

- This code is entered in the "STAT" field found on FISS claim page 01 or form locator 17 on the CMS-1450 form

- A listing of patient status codes is available by accessing the following resources:

- If you are using a billing software that calculates the episode dates and you are receiving this error, address this issue with your software vendor.

Reason Code 31102

Description:

Home health providers receive errors for this reason code for one of two reasons:

- The Request for Anticipated Payment (RAP) was submitted to Medicare containing Medicare Secondary Payer (MSP) information.

- The final claim was submitted for conditional Medicare payment due to an open MSP record posted to the beneficiary's eligibility file; however, not all of the required claim information for this type of payment was submitted on the claim.

Resolution:

- MSP information should not be submitted on RAPs, regardless of any MSP records impacting your dates of service. When billing your RAP to Medicare, ensure that you indicate Medicare as the primary payer.

- Review the Medicare Secondary Payer (MSP) Billing & Adjustments

tool for all of the MSP claim information required for conditional payments using either Process C, D, F, H, I, or J.

tool for all of the MSP claim information required for conditional payments using either Process C, D, F, H, I, or J. - When submitting your final claim to Medicare for a conditional payment, check the fields below to ensure the following data is entered:

- Occurrence code 24 is entered in form locator (FL) 31-34. The OCC CDS/DATE fields are found on FISS Page 01. Enter occurrence code 24 in the first available field on this page.

- Along with occurrence code 24, you must also submit one of the following when requesting a conditional Medicare payment in FL 31-34:

- The date of denial by the primary insurance;

- The date of last contact with the insurance/attorney; or

- The date of the Explanation of Benefits (EOB)

- Along with occurrence code 24, you must also submit one of the following when requesting a conditional Medicare payment in FL 31-34:

- Value code 12, 13, 14, 15, 16, 41, 43 or 47 and amount = 0000.00 is entered in FL 39-41. These fields are found on FISS Page 01.

- IMPORTANT: Make sure the value code you are submitting corresponds with the type of MSP record posted to the beneficiary's eligibility file.

- If your MSP claim can be submitted using FISS, a payer code of "C" should be entered on line A in the "CD" field on FISS Page 03.

- Detailed remarks describing the reason for requesting conditional payment should be entered in FL 80. This field is found on FISS Page 04.

- Occurrence code 24 is entered in form locator (FL) 31-34. The OCC CDS/DATE fields are found on FISS Page 01. Enter occurrence code 24 in the first available field on this page.

- If the MSP record involves a conditional payment due to a med-pay/no fault (value code 14), liability (value code 47), or worker's compensation (value code 15) insurance, ensure that one of the following occurrence codes and the effective date of the MSP record (as posted on the beneficiary's eligibility file) is submitted on your final claim in FL 31-34 (OCC CDS/DATE fields on FISS Page 01):

- 01, if med-pay

- 02, if no-fault

- 03, if liability

- 04, if worker's compensation

If your claim is suspended (S status code) and reason code 31102 is assigned to your claim, no provider action is required. Please do not contact CGS about a home health claim suspended with reason code 31102 unless it has been in the same suspended status/location for more than 60 days.

Reason Code 31147

Description:

A home health final claim was received, and the fifth position of the HIPPS code billed contains the letters S, T, U, V, W, or X, but supply revenue codes are not present on the claim.

Resolution:

- If the HIPPS code on your claim has a 5th position of S, T, U, V, W, or X and you provided non-routine supplies to the beneficiary during the episode, report

- Supply revenue codes 027X and/or 0623

- Service units

- Charges and

- A date of service that falls within the "FROM" and "TO" date of the home health claim

- CGS encourages you to use the first Medicare billable visit in the episode as the date of service submitted with revenue codes 027X or 0623.

- If non-routine supplies were NOT provided by your home health agency to the beneficiary during the episode, the 5th position of the HIPPS code must be changed to the appropriate numeric value of 1, 2, 3, 4, 5, or 6. For example, if the HIPPS code for the episode was 2BFKV, it will need to be changed to 2BFK4 if non-routine supplies were not provided to the beneficiary. Make sure that when changing the 5th position of the HIPPS code from a letter to a number or vice versa, you do not change the supply severity level assigned to the HIPPS code for the episode. See the table below for the supply severity levels and corresponding values to report whether non-routine supplies were provided during the episode.

Supply Severity Level Value if Supplies Provided Value if Supplies Not Provided 1 S 1 2 T 2 3 U 3 4 V 4 5 W 5 6 X 6 - Please note that the fifth position of the HIPPS code does not need to match between the final claim and the request for anticipated payment (RAP). Therefore, if the RAP is reported with the fifth position of the HIPPS code of 1, 2, 3, 4, 5, or 6 and non-routine supplies were provided, the RAP does not need to be canceled prior to submitting the final claim.

- However, you must ensure that the HIPPS code on the final claim is submitted with the corresponding letter for the supply severity level, and that the supply revenue codes, units, charges, and dates of service are present prior to submitting the claim.

Additional Resources

- Medicare Learning Network (MLN) Matters article MM5776

- Correction to the Editing of Health Insurance Prospective Payment System (HIPPS) Codes on Home Health Prospective Payment System (HH PPS) Claims -- MLN Matters article, MM6393

Updated: 12.26.2012

Reason Code 31287

Description:

Hospice claims must be billed monthly and must conform to a calendar month (Jan 1 – Jan 31). This means that only one claim per month for each patient.

Resolution:

Ensure the "From" date on the claim is one day after the "To" date on the previous claim. Ensure the "To" date on the claim is the last calendar day of the month (unless the beneficiary died, was discharged, or revoked hospice). Refer to the Hospice Sequential Billing Web page for additional information.

Reason Code 31428

Description:

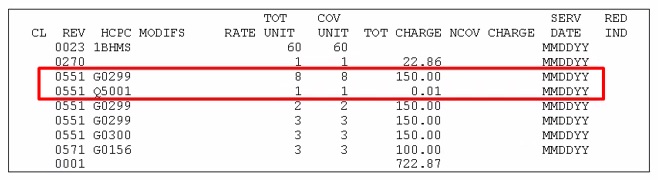

The claim contains a hospice discipline revenue code (42X, 43X, 44X, 55X, 56X, or 57X) and is either missing or has an incorrect corresponding HCPCS code (G0151, G0152, G0153, G0154, G0155, G0156).

Resolution:

- Ensure that your claim contains the appropriate HCPCS code on the discipline revenue code line.

Revenue Code (Discipline) HCPCS 042X (Physical therapy) G0151 043X (Occupational therapy) G0152 044X (Speech-language pathology) G0153 055X (Skilled nursing) G0299 (valid for services on or after January 1, 2016)

G0300 (valid for services on or after January 1, 2016)

G0154 (not valid for services on or after January 1, 2016)056X (Medical social services) G0155 057X (Aide) G0156 - Ensure that the HCPCS code is keyed using a "0" (number zero); not an "O" (letter O).

- Ensure that the HCPCS code begins with the letter "G"; not the letter "Q".

Additional resource:

- Hospice Medicare Billing Codes Sheet quick resource tool

- Medicare Claims Processing Manual (CMS Pub. 100-04), Ch. 11, §30.3

Updated: 12.11.2017

Reason Code 31485

Description:

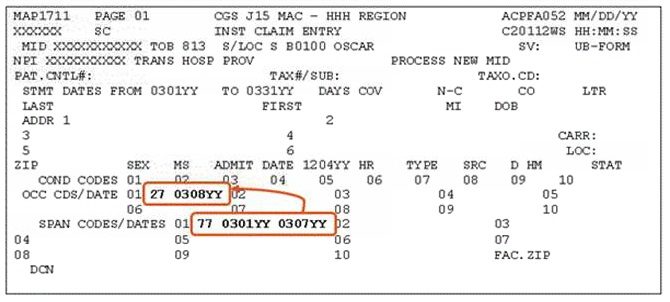

Occurrence code (OC) 27 is required on all hospice notice of elections (NOEs) and initial claims following a hospice election. The date included with OC 27 should match the FROM date and the ADMIT date, except for hospice transfer claim. A hospice NOE/claim will receive this error when:

- An NOE(8XA) is submitted without OC 27;

- The OC 27 date on the NOE does not match the 'FROM' date and the 'ADMIT DATE';

- An initial claim (8X1 or 8X2) following the hospice election or transfer (i.e. the 'FROM' date and 'ADMIT DATE' on the claim are the same) is submitted without OC 27; or

- For an initial hospice election, the OC 27 date on the initial claim does not match the 'FROM' date and the 'ADMIT DATE'.

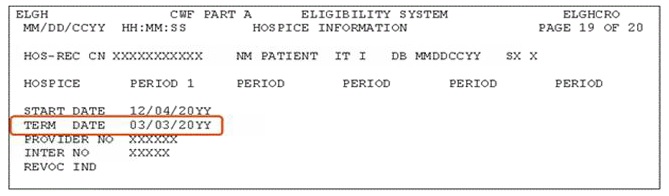

- For a hospice transfer, the OC 27 date is either:

- The START DATE of the current benefit period (as shown on ELGH/ELGA) that your claim falls within; or

- The START DATE of the next benefit period (according to ELGH/ELGA) when your claim's dates of service overlap the TERM DATE of the current benefit period.

Resolution:

- Ensure that your NOE (8XA) includes OC 27 with a date that matches the 'FROM' date and the 'ADMIT DATE'.

- Ensure that your initial claim (8X1 or 8X2) includes OC 27, and the date submitted with it matches the 'FROM' date and the 'ADMIT DATE'.

- For hospice transfers, ensure your initial claim (8X1 or 8X2) must include OC 27. The date submitted with the OC 27 is the START DATE of the current benefit period, OR the START DATE of the next benefit period.

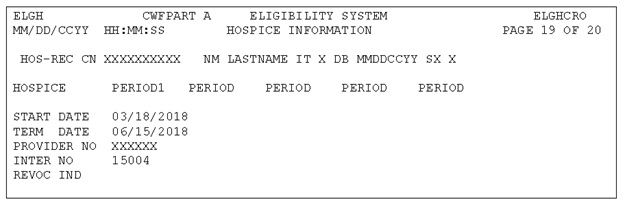

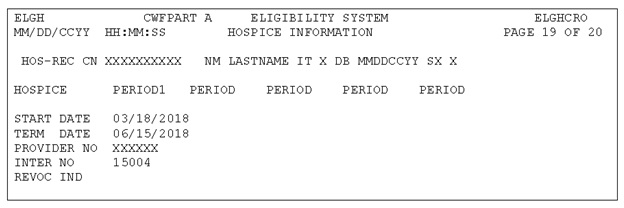

Example: ELGH shows the following:

If the dates of service on your initial claim are between March 18 and June 15, 20YY, the OC 27 date on your initial claim would be '031820YY'

If the dates of service on your initial claim are after June 15, 20YY, the OC 27 date on your initial claim would be '061620YY'.

Updated: 12.14.18

Reason Codes 31503

Description:

The total units on the level of care lines (0651, 0652, 0655, 0656) do not equal the number of days in the billing period.

Resolution:

- Ensure the total the number of days (i.e. units) for the level of care lines equals the number of days indicated by the FROM and TO date on the claim.

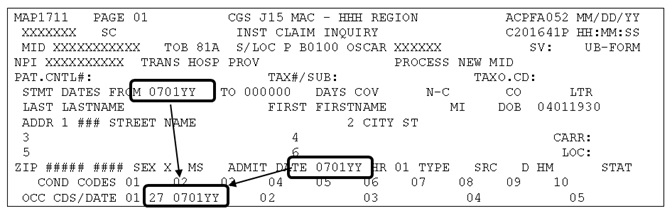

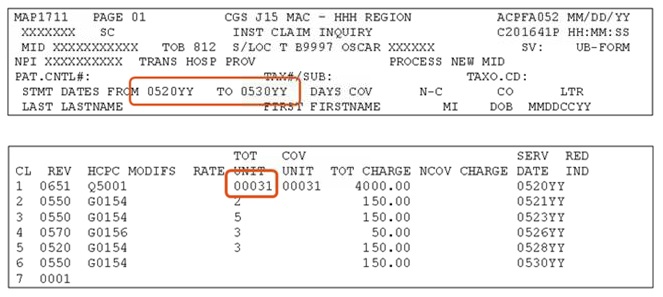

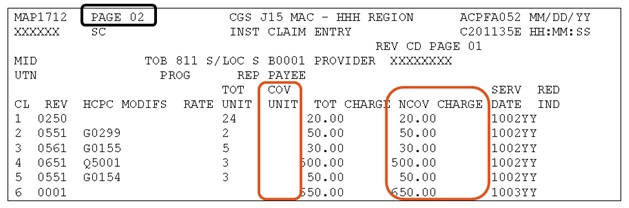

In the example below, the FROM and TO date reflect 11 days (0520YY-0530YY). However, the revenue code page (FISS Page 02) shows 31 days of routine home care (0651) were billed.

- For continuous home care, each 0652 revenue code line is equivalent to one day of care, regardless of the units billed on the 0652 line.

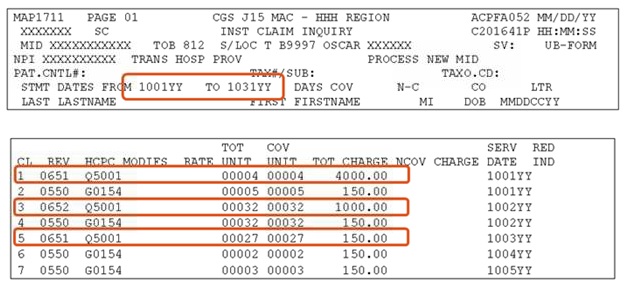

In the example below, the FROM and TO date reflect 31 days (1001YY-1031YY). However, the revenue code page (FISS Page 02) shows a total of 32 days (4 routine home care days + 1 day of continuous home care + 27 routine home care days = 32 days) were billed.

Reason Code 31605

Description:

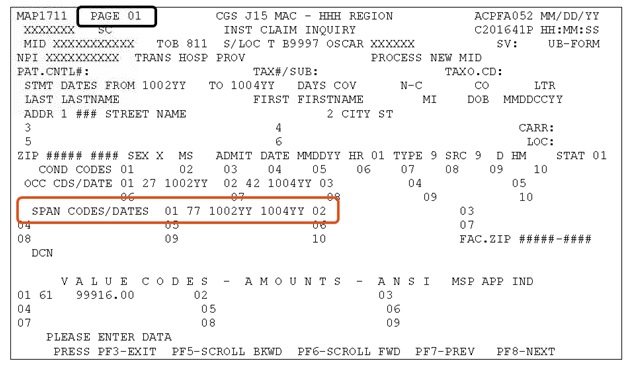

The dates of services on the claim cannot be within the span code 77 dates unless the charges are non-covered.

Resolution:

The occurrence span code 77 is used to indicate the span of days that were not covered on claims when one of the following situations occurred:

- The recertification was not obtained timely (by the end of the 3rd calendar day after the start of each benefit period). Enter the FROM and TO dates of the period of care for which the provider is liable. Note that condition code 85 (Delayed recertification of hospice terminal illness) must be reported for claims received on or after January 1, 2017. Refer to MM9590

for additional information.

for additional information. - The NOE was not submitted timely (within 5 calendar days after the hospice admission date). Enter the FROM and TO dates of the period of care for which the provider is liable.

NOTE: This code should not be used to indicate and untimely Face-To-Face encounter.

Refer the Occurrence Span Codes and Dates information found on the Claim Page 01 - Entering a Hospice Claim Web page.

Reason Code 31755

Description:

- One line item date of service (LIDOS) must match the date of service (DOS) billed on the 0023 revenue line, OR

- When the "FROM" date and the "ADMIT" date" are equal, the DOS billed with the 0023 revenue line must also match.

Resolution:

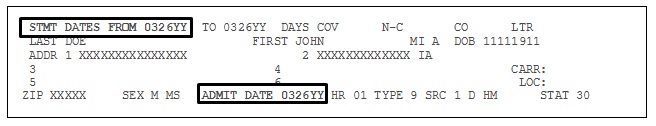

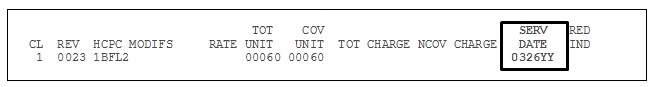

- Check "STMT DATES FROM" date (FL 6) and "ADMIT DATE" (FL 12) fields on FISS Page 01.

- If the dates are equal, check the "SERV DATE" field (FL 45) on the 0023 revenue line on FISS Page 02. The date in this field on this line must be the same as the date in FL 6 and FL 12 AND must reflect the date of the first visit in the episode.

FISS Page 01

FISS Page 02

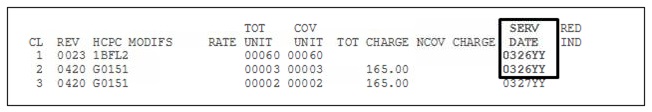

Final Claims Only:

- The "SERV DATE" field for one visit or service line must match the "SERV DATE" field on the 0023 revenue line.

- NOTE: You may need to press the F6 button to view additional revenue code pages to see all of the visits submitted on the home health final claim.

FISS Page 02

Updated: 10.11.12

Reason Code 31790

Description:

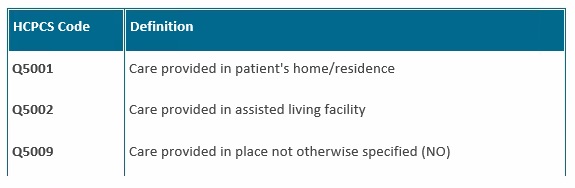

Due to data reporting requirements in Change Request 8136![]() , for home health final claims beginning on or after July 1, 2013, home health agencies must report the HCPCS code Q5001, Q5002, or Q5009 to indicate the location of where services were provided.

, for home health final claims beginning on or after July 1, 2013, home health agencies must report the HCPCS code Q5001, Q5002, or Q5009 to indicate the location of where services were provided.

Resolution:

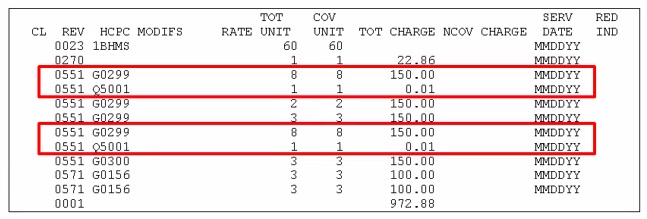

- Report the HCPCS code indicating the location of service along with the 1st billable visit in the HH PPS episode.

- Report the HCPCS code only once on a claim unless the location changes.

- Report the HCPCS code on an additional line item with the revenue code and date of service, one unit, and a nominal charge.

- If the location changes, report a new line item with the appropriate HCPCS code along with the 1st visit provided in the new location.

Posted: 02.21.20

Reason Code 32030

Description:

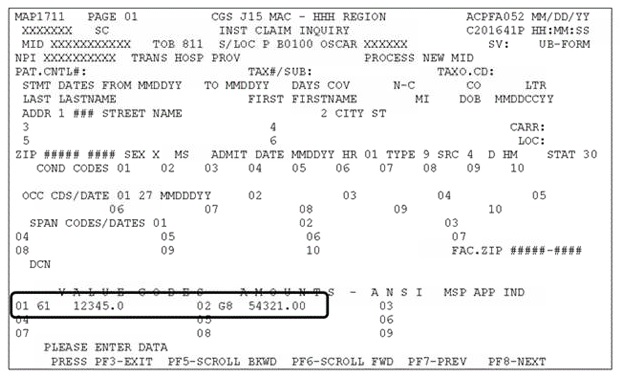

Value code G8 and/or 61 are required on hospice claims to indicate the location where the hospice care was provided.

- Revenue code 0655 (respite) and/or 0656 (general inpatient care) was submitted on the hospice claim; however, value code 'G8' is not present; AND/OR

- Revenue code 0651 (routine home care) and/or 0652 (continuous home care) was submitted on the hospice claim; however, value code '61' is not present.

Resolution:

Check FISS Claim Page 02 to review the levels of care billed on the hospice claim. Ensure that a value code G8 or 61 is present to reflect the location where the level of care was provided.

If revenue code 0655 (respite) or 0656 (general inpatient care) is present on your claim, a value code 'G8' is required in the value code field (FL 39-41 or 'Value Code' field on FISS Page 01).

If revenue code 0651 (routine home care) or 0652 (continuous home care) is present on your claim, a value code '61' is required in the value code field (FL 39-41 or 'Value Code' field on FISS Page 01).

Ensure that a Core Based Statistical Area (CBSA) code is submitted with the value code G8 or 61. The CBSA code must identify the location where the level of care was provided. A list of CBSA codes is available from the Hospice Agency Center Web page, http://www.cms.gov/Center/Provider-Type/Hospice-Center.html![]() , under the header "Wage Index Files".

, under the header "Wage Index Files".

Updated: 12.11.18

Reason Code 32072

Description:

Home health final claims are denied when the attending physician information reported on the claim has a termination date on the Provider Enrollment, Chain, and Ownership System (PECOS) and the termination date is equal to or prior to the dates of service on the claim.

Resolution:

Refer to the Ordering/Referring Physician Checklist for Home Health Agencies![]() quick resource tool for steps to take prior to submitting your home health final claim.

quick resource tool for steps to take prior to submitting your home health final claim.

When your home health claim is denied, you may appeal the denial by using the Reopening process. Refer to the Reopening webpage for additional information.

Posted: 04.20.21

Reason Code 32243

Description:

A home health billing transaction (Request for Anticipated Payment, final claim or adjustment) was submitted without a 0023 revenue code line OR a revenue code line for a visit was billed without charges.

Resolution:

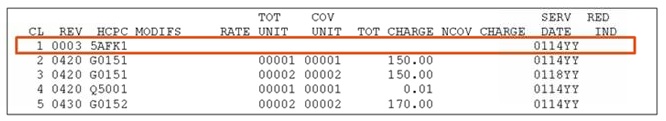

- Ensure that all billing transactions submitted for services paid under the Home Health Prospective Payment System (HH PPS) include a 0023 revenue code line. See the screenprint of FISS Page 02 below. A revenue code 0003 was entered on line 1 instead of a revenue code 0023.

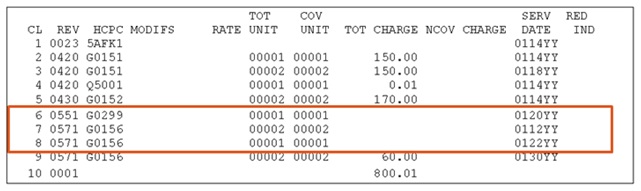

- Ensure that charges are entered for all revenue code lines reporting supplies or a visit. In the example of FISS Page 02 below, revenue code lines 6, 7, and 8 were billed without charges, resulting in the claim being returned with reason code 32243.

- Reminder: You may need to press the F5 and F6 keys when reviewing revenue code information on FISS Page 02 in order to determine which line item dates of service are missing charges.

- Reminder: You may need to press the F5 and F6 keys when reviewing revenue code information on FISS Page 02 in order to determine which line item dates of service are missing charges.

Posted: 04.11.16

Reason Code 32402

Description:

The home health or hospice claim includes at least one HCPCS code that is not valid, OR, at least one of the revenue code lines contains an invalid revenue code/HCPCS combination.

Resolution:

If you are billing a revenue code for skilled nursing, therapy or aide services, ensure the correct “G” HCPC code is reported. Refer to the listing below to ensure the correct revenue code and HCPC combination is reported.

Home Health Valid HCPCS Codes

| HCPCS Code | Valid For Dates of Service | Description |

| G0299 | Services provided on or after January 1, 2016 | Direct skilled nursing services of a registered nurse (RN) in home health or hospice setting, each 15 minutes. |

| G0300 | Services provided on or after January 1, 2016 | Direct skilled nursing of a licensed practical nurse (LPN) in the home health or hospice setting, each 15 minutes. |

| G0493 | Services provided on or after January 1, 2017 | Skilled services of a registered nurse (RN) for the observation and assessment of the patient's condition, each 15 minutes. NOTE: Only valid for home health providers. |

| G0494 | Services provided on or after January 1, 2017 | Skilled services of a licensed practical nurse (LPN) for the observation and assessment of a patient's condition, each 15 minutes. NOTE: Only valid for home health providers. |

| G0495 | Services provided on or after January 1, 2017 | Skilled services of a registered nurse (RN), in the training and/or education of a patient or family member, in the home health or hospice setting, each 15 minutes. NOTE: Only valid for home health providers. |

| G0496 | Services provided on or after January 1, 2017 | Skilled services of a licensed practical nurse (LPN), in th training and/or education of a patient or family member, in the home health or hospice setting, each 15 minutes. NOTE: Only valid for home health providers. |

For home health episodes that span 2015/2016 or 2016/2017, report the appropriate G-code on the detail line based on the date of service.

Hospice Valid HCPCS Codes

| HCPCS Code | Valid For Dates of Service | Description |

| G0299 | Services provided on or after January 1, 2016 | Direct skilled nursing services of a registered nurse (RN) in home health or hospice setting, each 15 minutes. |

| G0300 | Services provided on or after January 1, 2016 | Direct skilled nursing of a licensed practical nurse (LPN) in the home health or hospice setting, each 15 minutes. |

Home Health Invalid HCPCS Codes

| HCPCS Code | Invalid For Dates of Service | Description |

| G0154 | Services provided on or after January 1, 2016 | Direct skilled services of a licensed nurse (LPN or RN) in the home health or hospice setting, each 15 minutes. |

| G0162 | Services provided on or after January 1, 2017 | Skilled services of a licensed nurse (RN only) for management and evaluation of the plan of care, each 15 minutes. |

| G0163 | Services provided on or after January 1, 2017 | Skilled services of a licensed nurse (LPN or RN) for the observation and assessment of the patient's condition, each 15 minutes. |

| G0164 | Services provided on or after January 1, 2017 | Skilled services of a licensed nurse (LPN or RN), in the training and/or education of a patient or family member, in the home health or hospice setting, each 15 minutes. |

Hospice Invalid HCPCS Codes

| HCPCS Code | Invalid For Dates of Service | Description |

| G0154 | Services provided on or after January 1, 2016 | Direct skilled services of a licensed nurse (LPN or RN) in the home health or hospice setting, each 15 minutes. |

Reason Code 32907

Description:

A line item date of service (LIDOS) falls outside of the "FROM" and "TO" dates billed on the home health final claim.

Resolution:

- Verify the line items submitted on home health claims fall within the "FROM" and "TO" dates on the claim.

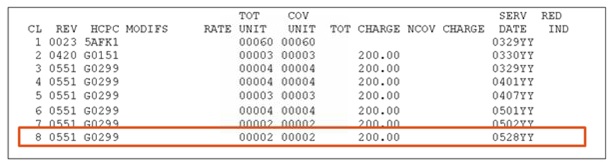

Example: Under a home health prospective payment system (HH PPS) a home health episode for March 29 to May 27 was submitted with a skilled nursing visit dated May 28 (see the boxed in revenue line #8 in the screenprint below), which falls outside of the "FROM" and "TO" date on the claim.

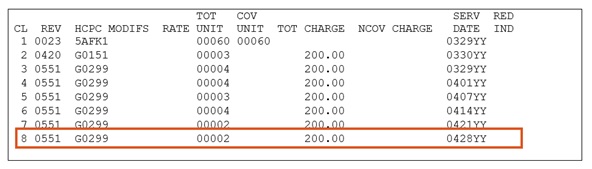

Example: Under the home health Patient-Driven Groupings Model (PDGM) a home health period of care for March 29 to April 27 was submitted with a skilled nursing visit dated April 28 (see the boxed in revenue line in the screenprint below), which falls outside of the “FROM” and “TO” date on the claim.

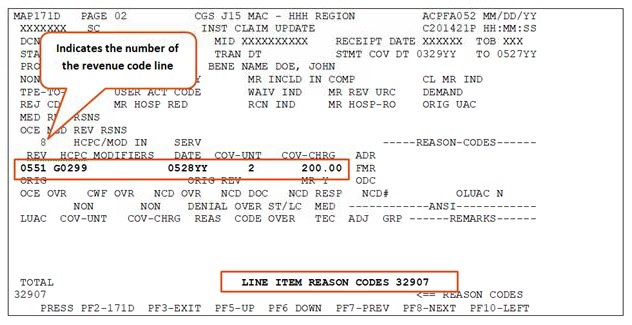

- If you are unable to determine which revenue codes falls outside of the "FROM" and "TO" dates after reviewing the "SERV DATE" field on FISS Page 02, use the Fiscal Intermediary Standard System (FISS) Inquiry Option 12 or Claims Correction Menu Option 27 to determine the LIDOS causing this error. After selecting the claim, press your F8 key to page forward to FISS Page 02. Press your F2 key to access MAP171D. Scroll through the individual revenue lines using the F6 key. A message, "LINE ITEM REASON CODES 32907" will appear for the date of service outside of the "FROM" and "TO" dates submitted on the claim. See the example below in the screenprint.

- Delete the revenue line with the incorrect date of service. You will need to add a new revenue line to submit the correct date of service. Another option is to submit a new claim to Medicare with the corrected information and suppress the view of the claim in your Return to Provider (RTP) file.

- Information about using FISS to add or delete revenue lines on Medicare claims, as well as, suppressing the view of claim can be found in Chapter 5- Claims Correction

of the Fiscal Intermediary Standard System (FISS) Guide.

of the Fiscal Intermediary Standard System (FISS) Guide.

- Information about using FISS to add or delete revenue lines on Medicare claims, as well as, suppressing the view of claim can be found in Chapter 5- Claims Correction

- A review of claims failing for this reason code shows episodes which span the calendar year are likely to receive this error. We encourage HHAs to have a process by which they check claims with dates of service that overlap the start of the calendar year to ensure the correct year is submitted on each line item date of service billed on the claim.

Updated: 01.17.2020

Reason Code 34923

Description:

This error is caused by one or more of the following:

- A revenue code line contains a service date that is within the occurrence span code (OSC) 77 dates, but the units and/or charges appear as covered;

- A revenue code line contains noncovered units or charges, but the service date is outside of the OSC 77 dates;

- The total noncovered days do not equal the total noncovered days indicated by OSC 77.

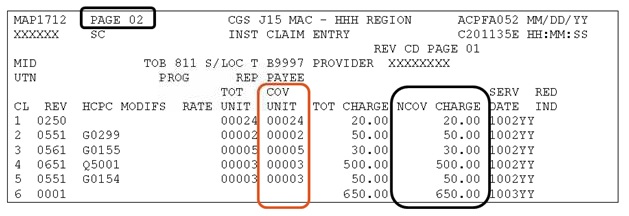

Example: FISS Claim Page 01 includes an OSC 77 with 1002YY-1004YY. On FISS Claim Page 02, the revenue code lines for dates of service 1002YY-1004YY appropriately report noncovered charges (NCOV CHARGE), however, the units are reported as covered (COV UNIT). This is causing RC 34923 to fire.

Resolution:

NOTE: Currently, providers that submit claims electronically, via the ANSI X12N version 5010, do not have a way to report noncovered units. As a result, FISS is incorrectly plugging covered units in the COV UNIT field, despite noncovered charges being reported. Providers experiencing errors for this reason may either submit the claim via Direct Data Entry (using FISS) to accurately report the units as noncovered, or if the claim is submitted electronically, it must be corrected from their Return to Provider (RTP) file once the reason code 34923 is applied.

How to prevent/resolve: When reporting an OSC 77 (untimely NOE or untimely recertification), verify that the units and charges are reported as noncovered (i.e. the COV UNIT field does not include any units) on the revenue code lines associated with the OSC 77 dates.

If the units were incorrectly entered as covered, you must delete and rekey each revenue code line where the units were reported incorrectly. Follow the steps below to resolve this error.

- Access the claim from the RTP file (Claim Correction menu

)

) - Go to FISS Page 02.

- Key a "D" over the first digit of the revenue code for each line you are deleting (those lines where the SERV DATE falls within the OSC 77 dates).

- Press the 'Home' key, then 'Enter'. The revenue code lines in which the "D" was entered will be deleted.

- Re-key the revenue code lines, ensuring that the COV UNIT field is blank for the noncovered lines, and charges are reported as noncovered (NCOV CHARGE).

For more information on deleting and rekeying revenue code lines, refer to the FISS Guide Chapter Five (Claims Correction).

Updated: 12.17.2018

Reason Code 34952

Description:

A service facility National Provider Identifier (NPI) was required on the claim, but was not reported. Hospice providers are required to report a service facility NPI when billing any of the following place of service HCPCS codes.

- Q5003 – hospice care provided in nursing long term care facility (LTC) or non-skilled nursing facility (NF)

- Q5004 – hospice care provided in skilled nursing facility (SNF)

- Q5005 – hospice care provided in inpatient hospital

- Q5006 – hospice care provided in inpatient hospice facility (when not the same as the billing hospice)

- Q5007 – hospice care provided in long term care hospital (LTCH)

- Q5008 – hospice care provided in inpatient psychiatric facility

Resolution:

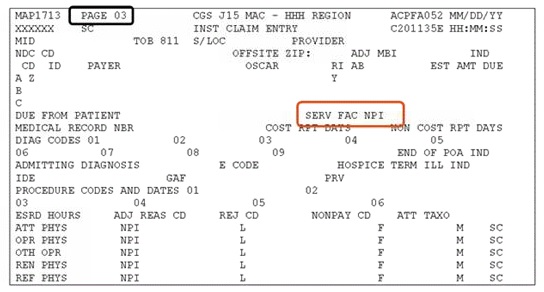

Before submitting your claim, check to see if any of the above HCPCS are present. If present:

- The NPI of the nursing facility, hospital, or inpatient facility where the patient received services is required. Enter the service facility NPI in:

- Loop 2310E (when billing in the 5010 electronic claim format); or

- SERV FAC NPI field in the Fiscal Intermediary Standard System (FISS) on Claim Page 03.

Reason Code 34982

Description:

The home health claim (type of bill 32X - excluding 320 and 322) is being returned because occurrence code 50 is not present

Resolution:

Ensure that the occurrence code 50 is reported on all final claims with dates of service on or after January 1, 2020. Occurrence code 50 must be reported with the OASIS assessment completion dates (OASIS item MO090) for the start of care, resumption of care, recertification or other follow-up OASIS that occurred most recently before the claim “From” date.

Refer to the Submitting a Final Claim under the Home Health Patient-Driven Groupings Model web page for additional billing requirements.

Reason Code 37186

Description:

The claim has been approved for payment.

Resolution:

No action needed.

Posted: 09.27.23

Reason Code 37236

Description:

Claims are denied with reason code 37236 when the NPI and/or physician's last name submitted on the home health claim does not match the physician's information at the Provider Enrollment, Chain, and Ownership System (PECOS).

Resolution:

- Verify that the attending physician's NPI is present in the PECOS eligible physician file

- Verify that the attending physician's name submitted on the claim matches the physician's name that is present in the PECOS file.

- Verify that the special code is a valid code.

If the physician NPI or name was entered incorrectly on the claim, or if the physician NPI or name was initially incorrect in PECOS, and has now been corrected, you may submit a reopening request. Refer to the Ordering/Referring Denial Reopenings information on the CGS website for details.

Reason Code 37237

Description:

Claims are denied with this reason code when the attending physician's National Provider Identifier (NPI):

- Is not present in the Provider Enrollment, Chain, and Ownership System (PECOS); or

- Is present on the claim, but the first four letters of the last name do not match the first four letters of the last name of the NPI record in PECOS; or

- The specialty code is not a valid and eligible code.

Resolution:

Home health services must be ordered or referred by a Doctor of Medicine (MD), Doctor of Osteopathy (DO), or Doctor of Podiatric Medicine (DPM). The physician who orders/refers the patient for home health care must be enrolled in the Medicare program, and have an enrollment record in PECOS.

Refer to the Ordering/Referring Physician Checklist for Home Health Agencies![]() quick resource tool for steps to take prior to submitting your home health final claim.

quick resource tool for steps to take prior to submitting your home health final claim.

If the physician's NPI or name was entered incorrectly on the claim, or if the physician's NPI or first four letters of the last name was initially incorrect in PECOS and has now been corrected, you may Reopening request. Refer to the Reopening webpage for additional information.

Posted: 04.20.2021

Reason Code 37238

Description:

The HCPCS G-code submitted is not reported with the correct corresponding revenue code.

Resolution:

Reason code 37238 will display when a G-code HCPCS is submitted with an incorrect revenue code. Before submitting your claim, ensure that the G-codes listed below are reported with the corresponding revenue code.

HCPCS |

Services performed in 15-minute increments |

REV Code |

|---|---|---|

G0151 |

Physical Therapy |

042X |

G0152 |

Occupational Therapy |

043X |

G0153 |

Speech-Language Pathology |

044X |

G0154 |

Direct skilled services of a licensed nurse (LPN or RN) NOTE: Not valid for visits made on or after 1/1/2016 |

055X |

G0155 |

Clinical Social Worker |

056X |

G0156 |

Home Health Aide |

057X |

G0157 |

PT assistant |

042X |

G0158 |

OT assistant |

043X |

G0159 |

PT establish or deliver safe and effective PT maintenance program |

042X |

G0160 |

OT establish or deliver safe and effective OT maintenance program |

043X |

G0161 |

SLP establish or deliver safe and effective SLP maintenance program |

044X |

G0162 |

RN (only) for management and evaluation of POC NOTE: Not valid for visits made on or after 1/1/2017 |

055X |

G0163 |

LPN or RN for the observation and assessment of the patient's condition |

|

G0164 |

LPN or RN training and/or education of patient or family member |

|

G0299 |

Direct skilled services of a licensed nurse (RN) |

055X |

G0300 |

Direct skilled services of a licensed nurse (LPN) |

055X |

G0493 |

RN for the observation and assessment of the patient's condition |

055X |

G0494 |

LPN for the observation and assessment of the patient's condition |

055X |

G0495 |

RN training and/or education of a patient or family member |

055X |

G0496(see note) |

LPN training and/or education of a patient or family member |

055X |

Resources:

- CGS Claim Page 02 – Entering a RAP or Claim

- MM9736

, Implementation of Policy Changes for the CY 2017 Home Health Prospective Payment

, Implementation of Policy Changes for the CY 2017 Home Health Prospective Payment - MM9369

, Additional G-Codes Differentiating RNs and LPNs in the Home Health and Hospice Settings

, Additional G-Codes Differentiating RNs and LPNs in the Home Health and Hospice Settings - MM7182

, New Home Health Claims Reporting Requirements for G Codes Related to Therapy and Skilled Nursing Services

, New Home Health Claims Reporting Requirements for G Codes Related to Therapy and Skilled Nursing Services

Reason Code 37253

Description:

This reason code is assigned when there is no corresponding OASIS assessment found in Medicare's systems related to the claim.

Resolution:

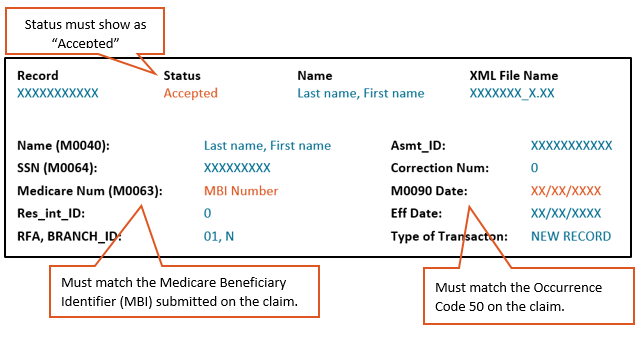

Before submitting your claim review the OASIS Final Validation Report (FVR) to ensure the OASIS assessment was successfully accepted. Below is an example of an FVR and the information that needs to match the claim.

- Check the FVR to confirm the receipt date shows the OASIS was accepted by iQIES before you submitted your claim. This date is shown on Page 1 of the report, in the "Completion Date/Time" field. Also ensure that the assessment has not been inactivated.

- If the OASIS was submitted after the claim, resubmit the claim. If the claim is in the RTP file (T B9997), press F9.

- If the assessment was inactivated, resubmit the assessment.

- Check the Reason for Assessment (RFA) (OASIS Item M0100). It must be equal to 01, 03, 04, or 05.

- If the claim matches an assessment that is for another reason, update the occurrence code 50 date on the claim to correspond to the M0090 date of the applicable assessment and resubmit the claim.

- Check the occurrence code 50 and ensure that you are reporting the assessment completion date (Item M0090).

- Check the claim you submitted with the OASIS to ensure the following items match.

- CMS Certification Number (OASIS Item M0010) – This is your agency's Medicare provider number, (often referred to as PTAN).

- Medicare Beneficiary Identifier (MBI) (OASIS Item M0063) – Effective January 1, 2020, regardless of the dates of service, all claims must be submitted with the new MBI. If the OASIS was submitted with the Health Insurance Claim Number (HICN), the OASIS will need to be corrected.

- Changes to a beneficiary's MBI may occur. Verify the MBI using the MBI look-up tool via myCGS. Refer to the myCGS MBI Look-up Tool for details on how to verify the MBI. If the MBI has changed, update Item M0063 on the OASIS and resubmit the claim.

- Assessment Completion Date (OASIS Item M0090) – This is the date submitted on the claim with occurrence code 50.

If the claim and OASIS have correct and matching information, contact the Provider Contact Center (PCC) at 1.877.299.4500 (Option 1).

If there is no error and it is determined the claim did not meet the condition of payment, submit a claim for denial using the following coding elements:

- Type of bill 0320, which indicates the expectation of a full denial

- Occurrence Span Code 77 with span dates matching the From/Through dates of the claim to indicate acknowledgement of liability for the billing period.

- Condition Code D2 indicating the change in billing the HIPPS code to non-covered.

- DO NOT use condition code 21.

References:

- OASIS Reference & Manuals

- SE20010 MLN Matters article, Ensure Required Patient Assessment Information for Home Health Claims

- MM9585 – Denial of Home Health Payments When Required Patient Assessment Is Not Received

- Internet Quality Improvement and Evaluation System (iQIES) Known Issues Log

Updated: 01.06.2026

Reason Code 37257

Description:

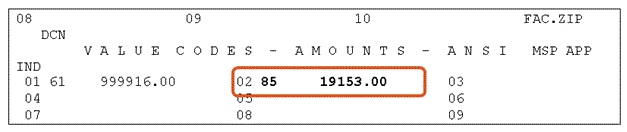

This reason code is assigned because the Value Code 85 and the Federal Information Processing Standards (FIPS) state and county code, is missing or invalid. The FIPS code is required on home health requests for anticipated payment (RAPs) and claims effective for dates of service on or after January 1, 2019.

Resolution:

For RAPs and claims with dates of service on or after January 1, 2019, ensure that Value Code 85 is present and the FIPS code. Value Code 85 is defined as “County Where Service is Rendered.”

The FIPS State and County Code can be found at the following websites:

When entering a value code that represents a number rather than a monetary amount, enter the number followed by two zeros. For example, FIPS code 19153 would be entered as 1915300 or 19153.00.

If the FIPS State and County Code begins with a zero, do not enter the zero. Enter the four digits that follow the zero. For example, 08019 would be entered as 801900 or 8019.00.

Reference:

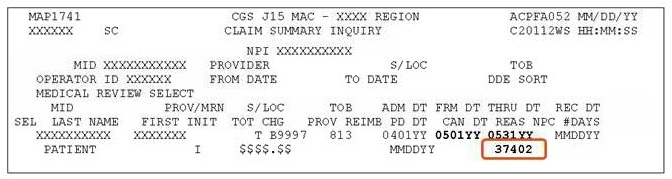

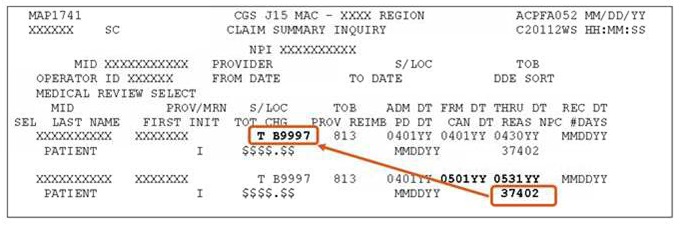

Reason Code 37402

Description:

A hospice claim was submitted, but the previous claim is not found OR there is a gap between the “TO” date of the previous claim and the “FROM” date on the next claim.

Resolution:

Hospice claims must be submitted sequentially. This means that January's claim, for example, must be submitted before February's claim can be submitted.

Check the FISS Claim Inquiry Option (Option 12) to determine if the prior claim was submitted.

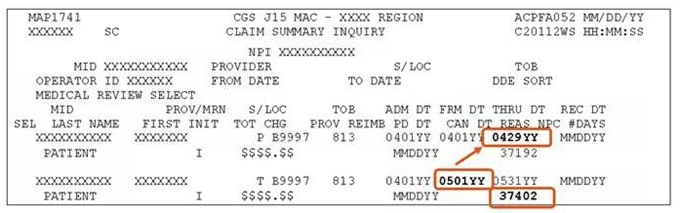

- Example below: No prior claim in FISS

If prior claim was submitted, ensure it is in a "P", "D", or "R" status code before submitting the next claim.

- Example below: Prior claim in "T" status; not "P", "D", or "R" as required.

Hospice claims must also be submitted consecutively. This means that there cannot be any skip in dates between the prior claim's "TO" date, and the next month's claim's "FROM" date; AND

Verify there is no gap between the "TO" date on the previous claim and the "FROM" date on the next claim.

- Example below: Gap in dates between prior claim's "TO" date (0429YY) and next claim's "From" date (0501YY).

In addition, Hospices are required to bill claims monthly (see Medicare Claims Processing Manual (CMS Pub. 100-04), Ch. 11, §90). This means providers should bill only one claim per month, for each patient. The "To" date on the claim must be the last calendar day of the month, unless the patient died, was discharged or revoked hospice during the month.

In addition, hospice claims must conform to a calendar month (Jan 1 – Jan 31). Claims that span two months (ex. Jan 1-Feb 1) will be sent to the RTP file for you to correct.

Note: You must correct the claims out of Return to Provider (RTP) file sequentially. For example if the January claim is in RTP because of an invalid HCPC code, and the February claim was submitted, the February claim would go to RTP because no prior claim was found. You must first correct the January claim. Once the January claim is corrected and moves to a suspended status/location, the February claim can be F9ed out of RTP.

Additional resources:

Reason Code 37541

Description:

An adjustment was submitted (Type of Bill XX7 or XXQ) with the condition code “D9” indicating “any other change” and no remarks are present in the “Remarks” field on FISS DDE page 04.

Resolution:

When submitting an adjustment, you must choose one of the following claim change reason codes that best describes the adjustment request. When “D9” is used, a detailed explanation of what is being adjusted must be included in the Remarks field (FL 80). The adjustment request will be suspended for review.

D0 – change dates of service

D1 – change charges

D2 – change revenue/HCPCS code

D7 – Change to make Medicare secondary

D8 – Change to make Medicare primary

D9* – Other/multiple changes

E0 – change patient status *

Reason Code 37545

Description:

Adjustments (type of bill XX7 or XXQ) will go to the Return to Provider (RTP) file when the Claim Change Reason Code “D2” is reported indicating a change is being made to a revenue code/HCPCS code; however, the adjustment revenue codes/HCPCS codes are the same as the original claim.

Resolution:

Please review your adjustment request to determine if changes need to be made to the revenue codes/HCPCS codes or if the Claim Change Reason Code needs to be changed. Make the necessary changes and press F9 to allow the adjustment to continue processing.

Refer to the Centers for Medicare & Medicaid Services (CMS) Pub. 100-04, Ch. 1, Section 130.1.2.1![]() for information about Claim Change Reason Codes. In addition, refer to the CGS Adjustments/Cancels web page for details about submitting adjustments.

for information about Claim Change Reason Codes. In addition, refer to the CGS Adjustments/Cancels web page for details about submitting adjustments.

Posted: 04.20.2021

Reason Code 38054

Description:

This home health claim overlaps a previously submitted home health claim for the same provider with at least one revenue code and corresponding charge the same.

Resolution:

Resolution: Prior to admission or submitting Notice of Admission (NOAs)/claims to Medicare, check the beneficiary's eligibility file to review established home health episodes for beneficiary, which may impact your dates of service.

Refer to the CGS Checking Beneficiary Eligibility Web page for more information about the systems available to providers to check Medicare beneficiary eligibility information.

If this claim includes negative pressure wound therapy (NPWT) services, enter “NPWT” in the remarks field on page 04 and press F9 to allow the claim to continue processing.

Reason Code 38107

Description:

Home health final claim submitted; however, a processed, matching RAP cannot be found.

Resolution:

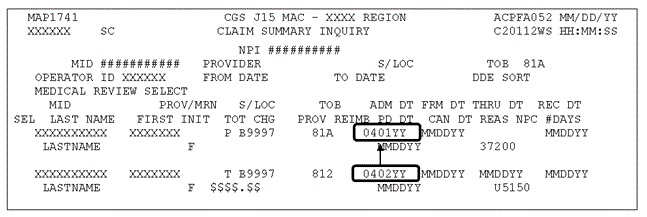

- Prior to submitting the final claim, access FISS Claim Inquiry option (Option 12) to determine if the RAP is in FISS status/location (S/LOC) P B9997

- You should not submit the final claim for the episode unless the RAP is in this S/LOC

- Review your Medicare Remittance Advice timely to verify the RAP has completed processing

- Submit the final claim timely according to regulations under the Home Health Prospective Payment System (HH PPS) and the Patient Driven Groupings Model (PDGM) based on the dates of service of the claim.

- Under HH PPS, submit the final claim prior to the greater of 60 days from when the RAP paid or the end of the episode

- Under PDGM for periods of care beginning January 1, 2020, submit the final claim prior to the greater of 60 days from when the RAP paid or the end of the 30-day period of care.

- Prior to submitting the final claim, ensure the RAP has not auto-canceled

- Step 1: Access FISS Inquiry Option 12

- Step 2: Enter your HHA's National Provider Identifier in the NPI field

- Step 3: Enter the beneficiary's Medicare number in the MID field

- Step 4: Enter P B9997 in the S/LOC field

- Step 5: Enter 328 in the TOB field

- Step 6: Enter your episode's start date in the FROM date field

- Step 7: Press Enter

- FISS will return a listing of billing transactions that meet the criteria entered

- If a 328 type of bill is displayed, tab down to it and key an "S" in the SEL field

- Press Enter

- Press your F8 key to page forward to FISS Page 03

- Review the information in the ADJUSTMENT REASON CODE field at the bottom of the screen

- If the letters NF appear in this field, FISS auto-canceled your RAP because the final claim was not received timely

- If your RAP auto-canceled, re-bill the RAP and wait for it to process (P B9997)

- Submit the final claim for the episode

- If FISS does not return a 328 TOB, press your F3 button and follow Steps 1 through 7

- If FISS still does not return a 328 TOB, then your RAP did not auto-cancel

- Submit the final claim for the episode

- Prior to submitting the final claim, ensure that the key information, listed below, for the episode's RAP and claim matches.

- Provider number/identifier of the billing home health agency (FL 56)

- "FROM" date of the episode (FL 6)

- Date of admission (FL 12)

- First four positions of the Health Insurance Prospective Payment System (HIPPS) code (FL 44)

- If the fifth position of the HIPPS code needs to change based on the provision of non-routine supplies, your HHA should ensure that the supply severity level between the RAP and final claim for the same episode of care does not change.

- Date of service billed with the HIPPS code (FL 45)

Reason Code 38031, 38157, 38158 and 38200

Description:

The Fiscal Intermediary Standard System (FISS) has found a previously submitted billing transaction for the same beneficiary and dates of service with the same provider number; therefore, the second billing transaction submitted by the provider is a duplicate.

Resolution:

- When using batch file transfer software, have an internal procedure in place to ensure batches of billing transactions are deleted from the software once they are submitted to Medicare.

- Review Medicare Remittance Advice timely.

- Stay current in posting payments received from Medicare.

- Access the FISS Claim Inquiry Option (Option 12) to determine which claims have been submitted to Medicare. For instructions on using FISS Inquiry Option 12, see Chapter 3 – Inquiry Menu

of the Fiscal Intermediary Standard System (FISS) Guide.

of the Fiscal Intermediary Standard System (FISS) Guide. - Do not resubmit an identical billing transaction if you have already corrected the claim from the Return to Provider (RTP) file.

- We encourage you to suppress the view of claims in your RTP file that you do not intend to correct. See Chapter 5- Claims Correction

of the Fiscal Intermediary Standard System (FISS) Guide for instructions on suppressing the view of claims in RTP.

of the Fiscal Intermediary Standard System (FISS) Guide for instructions on suppressing the view of claims in RTP.

- We encourage you to suppress the view of claims in your RTP file that you do not intend to correct. See Chapter 5- Claims Correction

- When appropriate, adjust rejected (R B9997) or paid (P B9997) claims instead of resubmitting them.

- If a billing transaction needs to be cancelled and resubmitted, the original billing transaction must be in FISS status/location P B9997 prior to the submission of the cancel claim. Prior to rebilling the corrected billing transaction, the 'cancel' claim (type of bill (TOB) XX8) must also be in P B9997.

- See Chapter 5- Claims Correction

of the Fiscal Intermediary Standard System (FISS) Guide for detailed instructions on adjusting or canceling home health and hospice billing transactions.

of the Fiscal Intermediary Standard System (FISS) Guide for detailed instructions on adjusting or canceling home health and hospice billing transactions.

- See Chapter 5- Claims Correction

- Ensure the TOB submitted is appropriate for the billing action needed, e.g., ensure that the TOB for an adjustment ends with a '7' and not '9', etc. For a listing of the appropriate types of bills submitted to Medicare, please review the appropriate chapter of the Medicare Claims Processing Manual

(CMS Pub. 100-04) for your provider type.

(CMS Pub. 100-04) for your provider type.

Providers should be aware that duplicate billing errors impact the Medicare program negatively by increasing the cost to process Medicare claims. Providers are also negatively impacted by the consequences of duplicate billing such as:

- Payment delays,

- Identification as an abusive biller, or

- The initiation of a fraud investigation if a pattern of duplicate billing is identified.

Reason Code 39071, 39072, 39073

Description:

This reason code will assign when your claim includes one or more diagnosis codes that match a Medicare Secondary Payer (MSP) record on the Common Working File (CWF).

Resolution:

Check the patient's eligibility file to determine whether your services may be related to the MSP record. You can also access myCGS to view specific diagnosis codes associated with MSP insurance types. Refer to the myCGS Enhancement: Diagnoses Associated with Medicare Secondary Payer (MSP) Records for details.

If your services are unrelated to the MSP record, and there is no new accident/injury, submit an adjustment to remove the related diagnosis code(s) from your claim once the claim has moved to R B9997.

If your services are related to the MSP record, submit an adjustment with the appropriate MSP information. Refer to the Medicare Secondary Payer Billing and Adjustments![]() quick resource tool for more information.

quick resource tool for more information.

Reason Code 39929

Description:

This claim was rejected due to an untimely Notices of Election (NOEs).

Resolution:

Hospices are required to submit NOEs within 5 calendar days after the hospice admission date. In order to be considered timely, the NOE must be submitted to and accepted by CGS within 5 calendar days after the hospice admission.

Important Note: If the NOE is submitted timely, but is returned to the provider (RTPd) for correction, the NOE is not considered to be "accepted" and thus, will result in an untimely NOE. Therefore, it is extremely important that hospices verify the information entered on the NOE before submitting it to CGS. In addition, hospices must verify the patient's eligibility information to reduce the risk of a claim RTPing due to an eligibility issue.

If an NOE is not corrected out of the RTP file (T B9997) within 5 calendar days after the hospice admission date, it is considered untimely.

Reason Code 7CS21

Description:

Dates of service billed are within a beneficiary Medicare Advantage (MA) plan enrollment period; therefore, no Medicare payment can be made.

Resolution:

- Review the information on the Medicare Advantage (MA) Plans – Claim Filing Tips When A Beneficiary Receiving Home Health Services Enrolls / Disenrolls Web page.

- Upon admission for Medicare-covered services, review all insurance (including Medicare Part D) cards the beneficiary has and verify the information on the card is valid.

- Upon admission and prior to billing CGS, verify whether an MA plan will impact the dates of service by checking the beneficiary's eligibility file. This information is available in the myCGS "Plan Coverage" tab. It can also be found on the "PLAN INFORMATION" screen found on ELGA Page 1 and/or ELGH page 5.

NOTE: In December 2012, CMS announced plans to discontinue the CWF Beneficiary eligibility transactions. In that same article, CMS announced that the HIPAA Eligibility Transaction System (HETS) would be the single source for this data. If you currently use CWF queries (HIQA, HIQH, ELGA, and ELGH) to obtain Medicare eligibility information, you should begin using HETS![]() .

.

- See the CGS Checking Beneficiary Eligibility Web page for more information about the systems available to providers to check Medicare beneficiary eligibility information.

- Since MA plan election records are updated the first part of each month, providers whose dates of service span two consecutive months or extend beyond 30 calendar days are encouraged to check MA plan information for the beneficiary monthly.

- Review the "Bill Code" field on the myCGS "Plan Coverage" tab or the OPT field on the ELGA page 1 and/or ELGA page 5 to determine where the claim needs to be sent for payment.

- If the OPT code or bill code is a 'C', the MA plan is responsible for processing the claim.

- According to the Medicare Claims Processing Manual, (CMS Pub. 100-04, Ch. 11, §30.4

), "While a hospice election is in effect, certain types of claims may be submitted by either a hospice provider, or a provider treating an illness not related to the terminal condition, to a fee-for-service contractor of CMS." In addition, "…the duration of payment responsibility by fee-for-service contractors extends through the remainder of the month in which hospice is revoked by hospice beneficiaries. MA plan enrollees that have elected hospice may revoke hospice election at any time, but claims will continue to be paid by fee-for-service contractors as if the beneficiary were a fee-for-service beneficiary until the first day of the month following the month in which hospice was revoked."

), "While a hospice election is in effect, certain types of claims may be submitted by either a hospice provider, or a provider treating an illness not related to the terminal condition, to a fee-for-service contractor of CMS." In addition, "…the duration of payment responsibility by fee-for-service contractors extends through the remainder of the month in which hospice is revoked by hospice beneficiaries. MA plan enrollees that have elected hospice may revoke hospice election at any time, but claims will continue to be paid by fee-for-service contractors as if the beneficiary were a fee-for-service beneficiary until the first day of the month following the month in which hospice was revoked."

- According to the Medicare Claims Processing Manual, (CMS Pub. 100-04, Ch. 11, §30.4

- If the OPT or bill code is a '1', services may be submitted to CGS for processing.

- If the OPT code or bill code is a 'C', the MA plan is responsible for processing the claim.

- The myCGS "Plan Coverage" tab will display the MA Plan's name, identifier, and contact information. If using ELGA/ELGH or the plan name and contact information is not available in myCGS, access the MA Claims Processing Contacts

directory, which contains a list of all active Medicare contracts and their corresponding plan type.

directory, which contains a list of all active Medicare contracts and their corresponding plan type. - If the MA plan election is posted to the beneficiary's eligibility file in error, the MA plan will need to correct this information. Providers should contact the MA plan directly to update the beneficiary's record.

- Providers should be aware that until the beneficiary's eligibility file is updated, any claims submitted to CGS will be impacted by the incorrect MA plan information; therefore, providers should not submit Medicare claims until the MA plan information is corrected.

- If the MA plan election was correctly posted to the beneficiary's file and impacts your dates of service, you must look to the MA plan for reimbursement of services. Do not submit billing transactions to CGS for payment, unless the eligibility file indicates the fee-for-service (FFS) contractor is responsible for processing the beneficiary's Medicare claims or there is a hospice election that impacts the MA plan enrollment period and your services are unrelated to the hospice election.

Updated: 01.28.20

Reason Code C7010

Description:

Records show that the beneficiary has elected the Medicare hospice benefit and services billed as being related to the terminal diagnosis.

Resolution:

- Verify with the beneficiary or their representative what health care services they are currently receiving at the time you admit them for Medicare home health care.

- Review the beneficiary's Medicare eligibility information posted to Common Working File (CWF) at the time of admission and prior to submitting home health Requests for Anticipated Payment (RAPs) and final claims to Medicare to determine whether the beneficiary has elected the hospice benefit and whether this election impacts your dates of service.

- See the CGS Checking Beneficiary Eligibility Web page for more information about the systems available to providers to check Medicare beneficiary eligibility information.

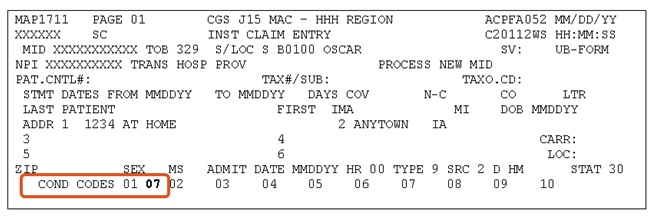

- If services are unrelated to the terminal diagnosis, ensure condition code "07" is entered in FL 18-28 of the CMS-1450 claim form. Enter this in the first available COND CODES field on FISS Page 01.

- Condition code "07" can only be used when the services are unrelated to the terminal diagnosis; any other use of condition code "07" may be considered abusive.

For additional information regarding the impact of a hospice election for beneficiaries receiving home health services, please see the CGS Election of the Medicare Hospice Benefit While Receiving Home Health Services During an MA Plan Enrollment Period Web page.

Updated: 10.24.2018

Reason Code C7080

Description:

A line item date of service (LIDOS) submitted on a home health claim overlaps a date of service on an inpatient claim. Per the Medicare Claims Processing Manual ( Pub. 100-04, Ch. 10, § 30.9![]() ), "Claims for institutional inpatient services, that is inpatient hospital and skilled nursing facility services, will continue to have priority over claims for home health services under HH PPS."

), "Claims for institutional inpatient services, that is inpatient hospital and skilled nursing facility services, will continue to have priority over claims for home health services under HH PPS."

Resolution:

- CGS encourages you to use the date of the first Medicare billable visit in the episode as the date of service you submit with revenue code 027X or 0623 when billing non-routine or surgical dressing/wound care supplies. In many cases, this is the LIDOS that overlaps the inpatient stay.

- If the inpatient facility has submitted their billing, you may be able to determine which date overlaps the inpatient stay by reviewing the DOEBA and DOLBA dates found on the beneficiary's eligibility file (ELGA page 01 or the myCGS Inpatient tab). Please be aware that the DOEBA and DOLBA dates reflect the first and last billing dates in an inpatient benefit period, and the beneficiary may have had multiple inpatient stays during a single inpatient benefit period.

- See the CGS Checking Beneficiary Eligibility Web page for more information about the systems available to providers to check Medicare beneficiary eligibility information.

- If you are unable to determine the overlapping date by looking at the beneficiary's eligibility file, please call the Provider Contact Center to receive this information. A listing of telephone numbers is accessible on the Customer Service Telephone Numbers Web page.

- Access the rejected claim to determine which dates of service on your home health claim overlap the inpatient stay. This information is available on FISS Page 02. You may need to press the F6 key to scroll forward to view all of the FISS revenue pages.

- Adjust the rejected claim using FISS Adjustment Option 33 to remove the incorrect date of service on FISS Page 02.

- REMINDER: when claims reject, charges are placed into the "NCOV CHARGES" (non-covered charges) field on FISS Page 02. When using FISS for online adjustments, the revenue detail lines must be deleted and added back by re-entering the revenue code information in new detail lines.

- For more information about adding and deleting revenue lines, access Chapter 5 - Claims Correction

of the Fiscal Intermediary Standard System (FISS) Guide. Detailed instructions are also found here for using FISS to adjust a rejected claim.

of the Fiscal Intermediary Standard System (FISS) Guide. Detailed instructions are also found here for using FISS to adjust a rejected claim. - REMINDER: to select a rejected claim, you must change the "P" that defaults in the S/LOC field to an "R" and enter "B9997". You may also need to change the TOB to "32".

- Ensure that all of the required data elements for an adjustment are present prior to submitting it to Medicare. These include:

- Type of bill (the third digit must be a "7")

- Claim Change Reason Code

- Document Control Number

- Adjustment Reason Code (if submitting via FISS)

- Remarks explaining the reason for the adjustment

- A listing of available Claim Change Reason Codes and Adjustment Reason Codes can be accessed from Chapter 5 - Claims Correction

of the Fiscal Intermediary Standard System (FISS) Guide.

of the Fiscal Intermediary Standard System (FISS) Guide.

Updated: 12.22.2015

Reason Code N5052

Description:

The beneficiary's Medicare ID number, name, sex, or date of birth submitted on the claim does not match the Medicare ID number, name, sex or date of birth in the Common Working File (CWF) eligibility records.

Resolution:

- Before submitting your claim, verify that the beneficiary's personal characteristics (name, sex or date of birth) and Medicare ID number on your claim matches the eligibility records, or the beneficiary's Medicare card. In addition to the correct spelling of the name, if the last name includes a space, you must also include a space when submitting your claim, or vice versa (e.g., McDonald vs. Mc Donald). Likewise, do not include a comma or a period unless the name appears as such (e.g. John Smith Jr vs. John Smith, Jr.). For additional information and the various systems available for providers to check eligibility, visit the "Checking Beneficiary Eligibility" CGS web page.

- Other resources that are available to verify the beneficiary's name, sex, date of birth and Medicare ID number include:

- Interactive Voice Response (IVR), 1-877-220-6289. Refer to the IVR Guide

for additional information.

for additional information. - Health Insurance Portability and Accountability Act (HIPAA) Eligibility Transaction System (HETS). For information about HETS, refer to the HETS User Guide

.

. - myCGS online web portal. For additional information about myCGS, refer to the myCGS User Guide.

- Interactive Voice Response (IVR), 1-877-220-6289. Refer to the IVR Guide

Updated: 12.30.2019

Reason Code U5106

Description:

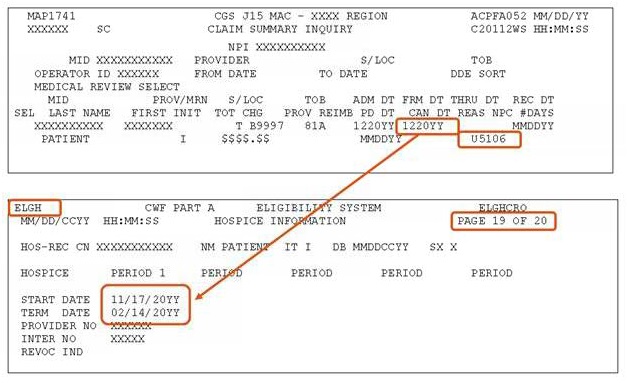

Hospice elections and benefit periods are posted to the Common Working File (CWF) when notice of elections (NOEs) and/or claims are processed. When another hospice NOE is submitted that overlaps the election/benefit period posted to CWF, including a duplicate NOE, the NOE will receive reason code U5106.

Resolution:

- Ensure that the NOE you are submitting is not a duplicate of a previously submitted/processed NOE. Use FISS Option 12 to check for previously submitted NOEs. Refer to the FISS DDE Guide, Chapter Three: Inquiry Menu

for information about Option 12.

for information about Option 12. - Before submitting an NOE (81A or 82A), review the beneficiary's hospice benefit periods on ELGH Page 19 or ELGA Page 18. Ensure the Admit Date on the NOE you are submitting does not fall within the START DATE and TERM DATE of the benefit period on ELGH/ELGA. Refer to the FISS DDE Guide, Chapter Two: Checking Beneficiary Eligibility

for information about ELGH/ELGA.

for information about ELGH/ELGA.

Reason Code U5111

Description:

This reason code is assigned to hospice 8XB or 8XD type of bills when the start date falls within a previously established hospice election period.

OR

This reason code is assigned to hospice 8XB or 8XD type of bills in the following situations:

- An 8XB is submitted after a final claim has been processed with a discharge patient status code.

- When a Notice of Transfer/Revocation (NOTR) is submitted (8XB), a revocation date and revocation indicator (1) will be posted on the Common Working File (CWF) election period screen. If a discharge claim is submitted in lieu of the NOTR, the claim will also post the revocation date and revocation indicator.

- An 8XB is submitted, but the start date does not fall within an established election period.

Resolution:

- Before submitting an 8XB type of bill, check to see if a final (discharge) claim (8X4 type of bill) has been submitted with a discharge patient status code (01, 50 or 51). If a final claim has been submitted with a discharge patient status code, the 8XB does not need to be submitted.

- If the 8XB is in the Return to Provider (RTP) file (T B9997 status/location), do not press F9. You can suppress the view, as this does not need to be submitted. Refer to the FISS DDE Guide, Chapter Five: Claims Corrections

for information about to suppress the view of a claim in RTP.

for information about to suppress the view of a claim in RTP.

- If the 8XB is in the Return to Provider (RTP) file (T B9997 status/location), do not press F9. You can suppress the view, as this does not need to be submitted. Refer to the FISS DDE Guide, Chapter Five: Claims Corrections

- If an 8XB or 8XD is submitted, ensure that the “FROM” date on the claim matches the start date of the hospice election period.

- When there is no change in the provider number during the election, submit the start date of the election period as the “FROM” date on the NOTR

- If the beneficiary transferred to your hospice during the benefit period, the FROM date must match the START DATE 2 on the benefit period that initiated the transfer. The START DATE 2 field is available on the FISS DDE MAP175I (Inquiry Option 10, Beneficiary/CWF). Refer to the FISS DDE Guide, Chapter Three: Inquiry Menu

for additional information.

for additional information. - If the revocation follows a change of ownership, the “FROM” date on the NOTR must match the OWNER CHANGE start date on the benefit periods.

Resources:

Reason Code U5150

Description:

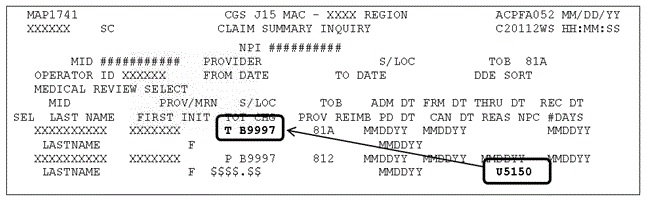

A hospice claim was received; however, no Notice of Election (NOE) is on file.

Resolution:

Before submitting the hospice claim, use FISS Option 12 to verify the NOE has been submitted and processed. To be considered processed, an NOE must appear in status/location P B9997.

Example: The NOE has been submitted, but did not process; it appears in the return to provider (RTP), status/location T B9997.

- Never submit an NOE and claim on the same day.

- Using FISS Option 12 (Claims), verify the ADMIT DATE on the NOE and claim are the same.

Reason Code U5181

Description:

Hospices use occurrence code (OC) 27 and the date on all notices of election (NOEs) and initial claims following a hospice election. OC 27 and the date are also required on all subsequent claims when the claim's dates of service overlap the first day of the next benefit period. When OC 27 is required, but not reported, or does not include the correct date, the NOE or claim will receive this reason code.

Resolution:

- Ensure OC 27 is submitted on all NOEs in field locator (FL) 31-34 of the CMS-1450 (UB-04) claim form. The OC 27 date must match the "From" date (FL 6) and "Admit Date" (FL 12) on the NOE.

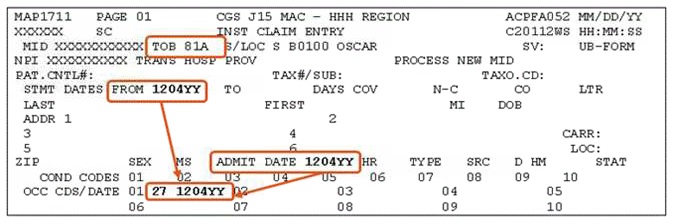

For example: The beneficiary elected the hospice benefit on December 4, 20YY. When submitting the NOE, the "From" date, "Admit date" and OC 27 date must all be 1204YY.

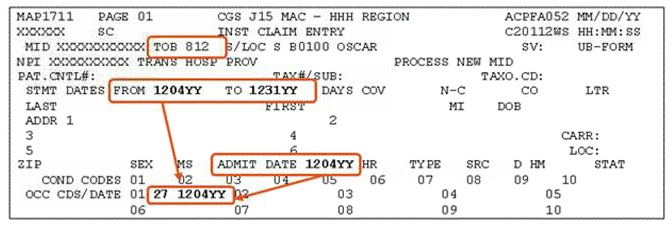

- Ensure OC 27 is submitted on an initial claim (the first claim following a beneficiary's hospice election). The OC 27 date must match the "from" date and the "Admit date" on an initial claim.

- Example: The beneficiary elected the hospice benefit on December 4, 20YY. The initial claim's "From" and "To" dates are December 4 to December 31, 20YY. OC 27 and the date, 1204YY, are required on the claim.

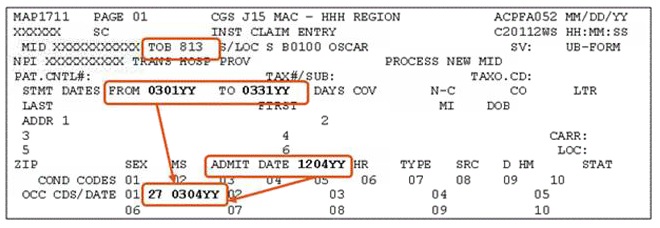

- Ensure OC 27 is submitted on subsequent claims when the claim's dates of service overlap the first day of the next benefit period. When the recertification is obtained timely (by the end of the third calendar date after the new benefit period starts), the OC date must be the first day of the new benefit period. (For untimely recertifications, see below.)

- Example: Using our previous scenario, the 1st day of the next benefit period is March 4, 20YY (90 days from December 4, 20YY). A claim with dates of service March 1 to March 31, 20YY, would require the OC 27 with the 0304YY date.

- For untimely recertifications, the OC 27 date cannot fall within the occurrence span code (OSC) 77 dates. When a recertification is not obtained timely (by the end of the third calendar day), ensure OSC 77 is submitted on the claim in FL 35. The OC 27 and date must reflect the date the recertification was actually obtained; it cannot occur within the OSC 77 dates.

- Example: The new benefit period began on March 3, 20YY. However, the recertification was not obtained until March 8. As a result, OSC 77 is used to indicate the noncovered days 0303YY to 0307YY. The OC 27 date indicates the date the recertification was actually obtained: 0308YY.

- Verify the correct OC 27 date using ELGH/ELGA. The majority of errors for U5181 occur because the date submitted with OC 27 is incorrect. The eligibility systems, ELGH or ELGA, can be used to determine/verify the first day of the next hospice benefit period, and thus, the correct OC 27 date. The next benefit period begins one day after the "Term Date" of the previous benefit period. This is the correct date to use with OC 27.

- Example: ELGH Page 19 shows the prior benefit period's "Term Date" as 03/03/YY. The next benefit period would begin on 03/04/20YY. As a result, the March claim must include OC 27 with the date 0304YY (the first day of the next benefit period.)

Ensure OC 27 is submitted correctly. If OC 27 is required, but is missing from the NOE/claim, or the date associated with OC 27 is incorrect, the NOE/claim will be sent to your RTP file with reason code U5181.

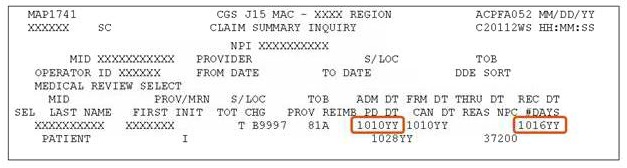

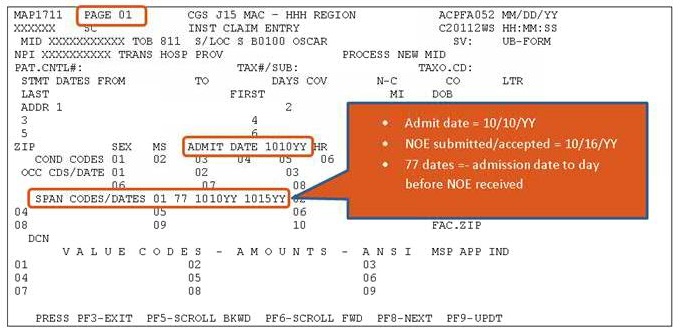

Reason Code U5194

Description:

The occurrence span code (OSC) 77 is missing or the dates are incorrect.

Resolution:

The hospice notice of election (NOE) must be received within 5 calendar days after the effective date of the hospice election. When the NOE is not received timely, Medicare will not cover/pay for days of care from the admission date to the date the NOE was submitted/accepted. OSC 77 must be reported to identify the dates from the date of admission to the date before the NOE was received.

Use FISS Option 12 to determine the date CGS received the NOE.

Example of timely/untimely NOE calculation:

- Admission date = 10/10/YY

- Day 1 = 10/11/YY

- Day 2 = 10/12/YY

- Day 3 = 10/13/YY

- Day 4 = 10/14/YY

- Day 5 = 10/15/YY (This is the NOE "due date")

If the NOE is received and accepted on/after 10/16/YY, it is untimely.

The following is an example of an untimely NOE and shows the admission date of 10/10/YY with a receipt date of 10/16/YY.

When an NOE is untimely, the noncovered days from the admission date to the day before the NOE was received must be reported on the claim with the occurrence span code 77.

NOTE: When the NOE is untimely, the revenue code lines/charges for the noncovered level of care days, (OSC 77), must be submitted as noncovered on FISS Page 02.

Resources:

- MLN Matters® Article MM8877

, "Hospice Manual Update for Diagnosis Reporting and Filing Hospice Notice of Election (NOE) and Termination or Revocation of Election."

, "Hospice Manual Update for Diagnosis Reporting and Filing Hospice Notice of Election (NOE) and Termination or Revocation of Election." - Change Request 8877 Frequently Asked Questions

- Submitting Claims for Untimely Notices of Election (NOEs)

Reason Code U5211

Description:

The dates of service (From and To Date) on the claim overlap the date of death on file for the patient at Common Working File (CWF).

Resolution:

- Review the beneficiary's eligibility record to determine the date of death on file.