Reopenings Reprocess Claim Adjustment Request Form (REP 913)

Form REP 913![]() (Reopenings Reprocess Claim Adjustment Request Form) will allow you to submit a request to reprocess a claim that denied when there are no changes or updates to make to the actual claim. Examples include:

(Reopenings Reprocess Claim Adjustment Request Form) will allow you to submit a request to reprocess a claim that denied when there are no changes or updates to make to the actual claim. Examples include:

NON-MSP

- Update to fee schedule or update to allow new procedure codes.

- Global surgery denials that should be reversed due to an update to a different claim.

- An erroneous duplicate denial. NOTE: Make sure the duplicate denial is incorrect; otherwise the adjustment may result in payment errors and/or recoupments.

MSP

- A patient's file was updated to show Medicare should pay as primary on a claim we originally processed and denied as secondary.

- Includes Medicaid timely filing claims.

Only one claim can be corrected per form.

NOTE: In order to complete the form accurately, you must have access to your Remittance Advice (RA). If you download your RA from a billing service or clearinghouse, the line items may be in a different sequence, which will affect the processing on this form. We suggest accessing your RA directly from the myCGS® Web Portal.

Also, to avoid issues with legibility, we encourage you to complete the form online, and then print it.

Automated Reopenings Reprocess Claim Adjustment Request Form Instructions

- Complete the Header of the form:

- Select the State

- Enter the date the form is completed

- Enter a contact person's name and telephone number

NOTE: This information is important should we need to contact you with a question regarding your Reopening request.

- Complete the Provider Information section:

- Identify the last 5 digits of Tax ID number

- Enter the Billing PTAN

- Individual physicians/practitioners who reassign benefits to a group, enter the Group PTAN.

- Solo physicians/practitioners, enter the Individual PTAN.

- Enter the Billing NPI

- Individual physicians/practitioners who reassign benefits to a group, enter the Group NPI.

- Solo physicians/practitioners, enter the Individual NPI.

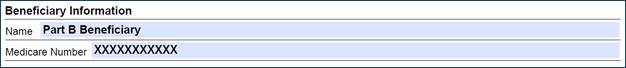

- Complete the Beneficiary Information section:

- Enter the Beneficiary's Name

- Enter the Beneficiary's Medicare ID

- To avoid processing delays, please verify that the Medicare ID is correct.

- To avoid processing delays, please verify that the Medicare ID is correct.

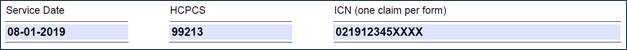

- Identify the claim information:

- Enter a Date of Service from the claim.

- Identify a HCPCS/CPT code (procedure code) that corresponds to the date of service.

- Enter the Internal Control Number (ICN) of the claim, which is located on the RA.

- Verify that the ICN is accurate. Incorrect, incomplete, or invalid ICNs will result in increased processing time (up to 60 days).

- Verify that the ICN is accurate. Incorrect, incomplete, or invalid ICNs will result in increased processing time (up to 60 days).

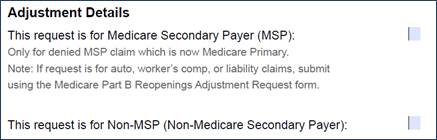

- Complete the Adjustment Details section:

- Check the appropriate box:

- Select Medicare Secondary Payer (MSP) when Medicare is now the primary payer on a claim originally processed as secondary.

- NOTE: Cases involving auto, Worker's Comp, or liability claims must be submitted on the Medicare Part B Reopenings Adjustment Request - GRF 679

.

.

- NOTE: Cases involving auto, Worker's Comp, or liability claims must be submitted on the Medicare Part B Reopenings Adjustment Request - GRF 679

- Select Non-MSP for all other requests.

- Select Medicare Secondary Payer (MSP) when Medicare is now the primary payer on a claim originally processed as secondary.

- Check the appropriate box: