January 9, 2020

NATIONAL Fiscal Year (FY) 2019 Medicare Fee-For-Service Improper Payment Rate is Lowest Since 2010

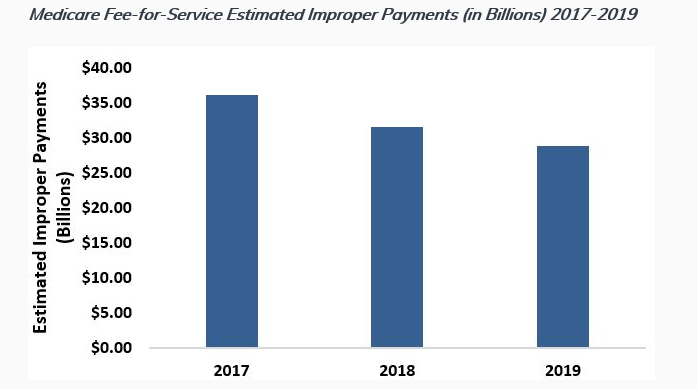

The Centers for Medicare & Medicaid Services (CMS) announced today that the Medicare Fee-For-Service (FFS) improper payment rate has fallen yet again, and is at its lowest level since FY 2010. Today's announcement reinforces the Trump Administration and CMS' commitment to strengthening Medicare and ensuring that tax dollars are spent appropriately. CMS' aggressive program integrity measures lowered the estimated amount of Medicare fee-for-service (FFS) improper payments $7 billion from FY 2017-2019 to a total of $28.9 billion.

The Medicare FFS estimated improper payment rate decreased to 7.25 percent in FY 2019, from 8.12 percent in FY 2018, the third consecutive year the Medicare FFS improper payment rate has been below the 10 percent threshold for compliance established in the Improper Payments Elimination and Recovery Act of 2010. This year's decrease was driven largely by progress in a number of important areas:

- Home health claims corrective actions, including policy clarification and Targeted Probe and Educate for home health agencies, resulted in a significant $5.32 billion decrease in estimated improper payments from FY 2016 to FY 2019.

- Other Medicare Part B services (e.g., physician office visits, ambulance services, lab tests, etc.) saw a $1.82 billion reduction in estimated improper payments in the last year due to clarification and simplification of documentation requirements for billing Medicare under our Patients Over Paperwork initiative.

- Durable Medical Equipment, Prosthetics, Orthotics, and Supplies improper payments decreased an estimated $1.29 billion from FY 2016 to FY 2019 due to various corrective actions implemented over the years.

Service Areas Driving Improper Payments

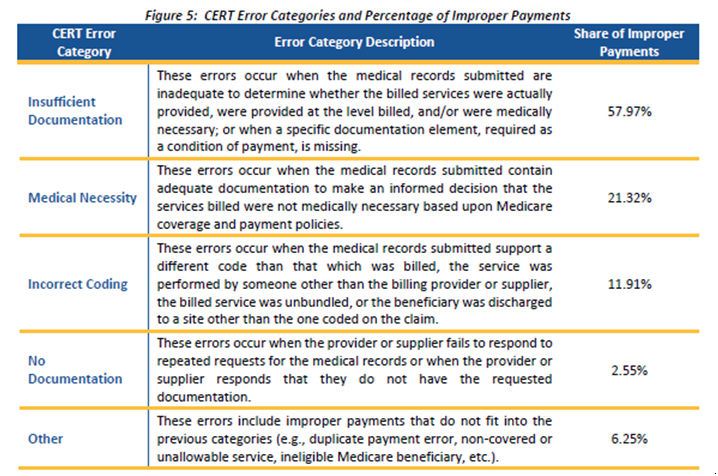

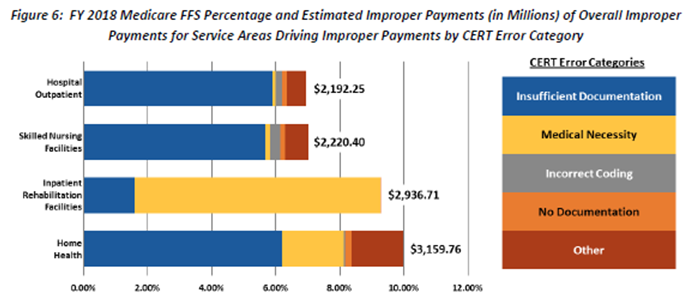

The Medicare FFS gross improper payment estimate for FY 2018 is 8.12 percent of total outlays or $31.62 billion. The FY 2018 net improper payment estimate is 7.58 percent of total outlays or $29.52 billion. The decrease from the prior year's reported improper payment estimate of 9.51 percent was driven by a reduction in improper payments for home health and SNF claims. Although the improper payment rate for these services and the gross Medicare FFS improper payment rate decreased, improper payments for home health, IRF, SNF, and hospital outpatient claims were the major contributing factors to the FY 2018 Medicare FFS improper payment rate, comprising 33.24 percent of the overall estimated improper payment rate. While the factors contributing to improper payments are complex and vary by year, the primary causes of improper payments continue to be insufficient documentation and medical necessity errors as described in the following four driver service areas:

- Insufficient documentation for home health claims continues to be prevalent, despite the improper payment rate decrease from 32.28 percent in FY 2017 to 17.61 percent in FY 2018. The primary reason for these errors was that documentation to support the certification of home health eligibility requirements was missing or insufficient. Medicare coverage of home health services requires physician certification of the beneficiary's eligibility for the home health benefit (42 Code of Federal Regulations [CFR] 424.22).

- Medical necessity (i.e., the services billed were not medically necessary) continues to be the major error contributor for IRF claims. The improper payment rate for IRF claims increased from 39.74 percent in FY 2017 to 41.55 percent in FY 2018. The primary reason for these errors was that the IRF coverage criteria for medical necessity were not met. Medicare coverage of IRF services requires a reasonable expectation that the patient meets all of the coverage criteria at the time of IRF admission (42 CFR 412.622(a)(3)).

- Insufficient documentation continues to be the major error reason for SNF claims. The improper payment rate for SNF claims decreased from 9.33 percent in FY 2017 to 6.55 percent in FY 2018. The primary reason for these errors was that the certification/recertification statement was missing or insufficient. Medicare coverage of SNF services requires certification and recertification for these services (42 CFR 424.20).

- Insufficient documentation is the major error reason for hospital outpatient claims. The improper payment rate for hospital outpatient claims decreased from 4.38 percent in FY 2017 to 3.25 percent in FY 2018. The primary reason for these errors was that the order (or intent to order for certain services) or medical necessity documentation was missing or insufficient (42 U.S.C 1395y, 42 CFR 410.32).

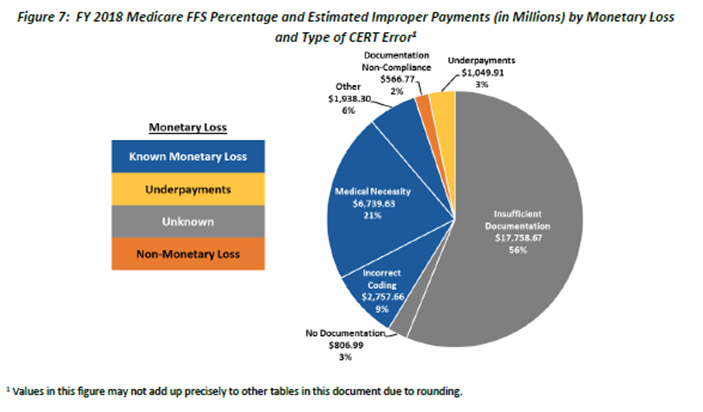

Monetary Loss Findings

Improper payments do not necessarily represent expenses that should not have occurred. Instances where there is insufficient or no documentation to support the payment as proper are cited as improper payments. The majority of Medicare FFS improper payments are due to documentation errors where HHS could not determine whether the billed services were actually provided, were provided at the level billed, and/or were medically necessary. In Figure 7, "unknown" represents payments where there was insufficient or no documentation to support the payment as proper or a known monetary loss. In other words, when payments lack the appropriate supporting documentation, validity cannot be determined. These are payments where more documentation is needed to determine if the claims were payable or if they should be considered monetary losses to the program.

HHS Agency Financial Report Section 3, Payment Integrity Report Section 11.1![]()